how to find bull flag stocks

Screening for Intraday BULL Flags on Indian Stock Market. When I tested scan for bull.

Bullish Flag Chart Patterns Education Tradingview

83 Bull Flag vs.

. How to trade the bull flag set up. 1 day agoA potential silver lining could be that the sell-off creates opportunities to buy excellent businesses at bargain prices. Buy the day after the inside day 5 cents above the XBO days high and risk one point.

We use cookies to personalize content and ads to provide social media features and to analyze our traffic. This designation depends on what the flag says about where the price is headed. And over time it has evolved from a rigid pattern form into.

Get 100 Free Email Alerts about Hot Penny Stocks. The pattern takes shape when the stock retraces by going sideways or by slowly. The top line is resistance and the bottom line is support.

After a massive move up wait for a pullback. Bull Flag Pattern trading strategy guide Now Lets take what youve learned and develop a Bull Flag trading strategy. After the pullback find support it creates a.

We can help guide you through all phases of bull markets. Day 1 - Stock must make an expansion breakout XBO. 91 Pay Attention to the Resistance.

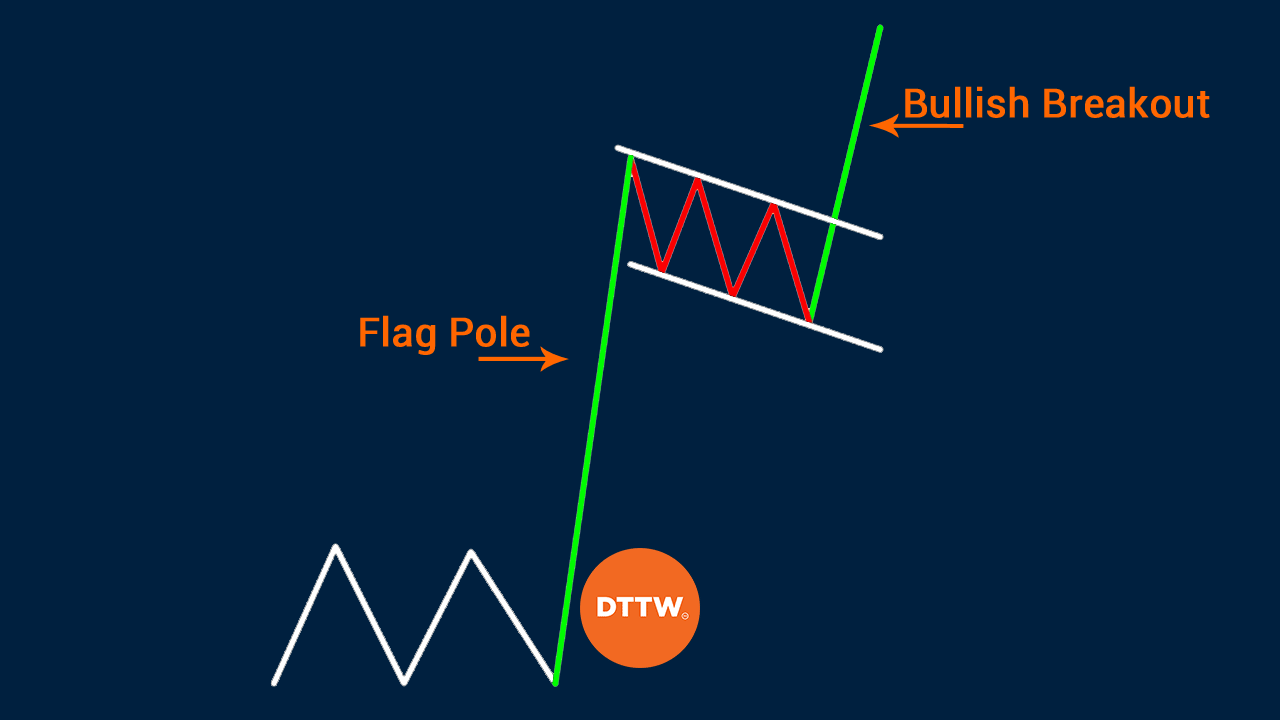

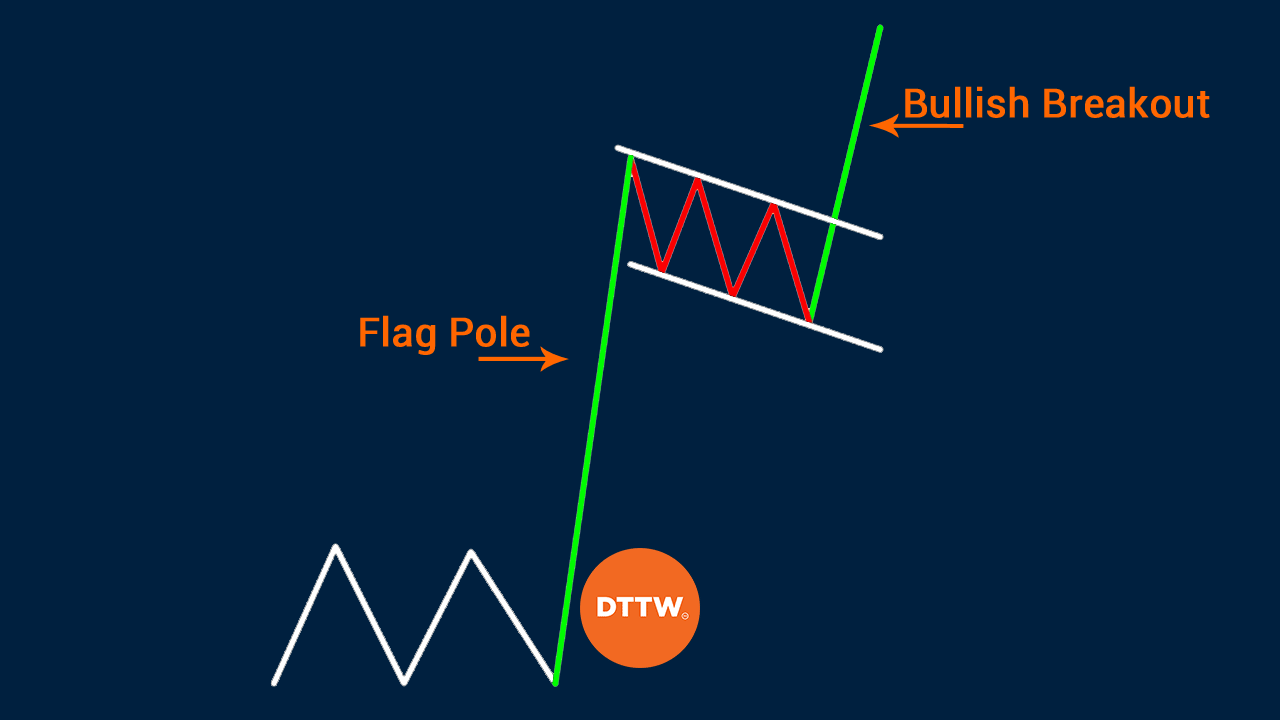

Our Picks Generate Huge Profits For Our Subscribers With Just A Very Small Investment. A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. For example the bull flag pattern is where the flag.

If the flagpole price peak is exceeded then you can use Bollinger Bands and or fib price levels. Ad We Take The Complication Out Of Stock Trading So You Can Easily Profit. Draw the support and resistant lines and you will notice a flag pattern.

Its screener has built in predefined function that can find stocks with Flags or Pennants. A bull flag is a continuation chart pattern that signals the market is likely to move higher. Screening for Intraday BULL Flags on Indian Stock Market.

There is no specific timeframe to spot the bull flag. The bull flag is a classic price action pattern for trading pullbacks. Youll find it on every list of essential chart patterns.

The first step in identifying the pattern is to locate the pole which is representative of a significant rise in the stock price and is the starting point in the formation of the pattern. To trade this strategy. Day 2 - Stock must form an inside day.

Heres how to spot one. Bull Flag Chart Pattern Trading Strategies - Warrior Trading. Ad Penny Stock Traders Have Made Huge Profits.

You can use a stock screener such as Finviz to help you find bull flags occurring in stocks. Diversify your portfolio by investing in art real estate legal and more asset classes. This entry point is a move above the downtrend resistance within the flag in the case of a bull pennant.

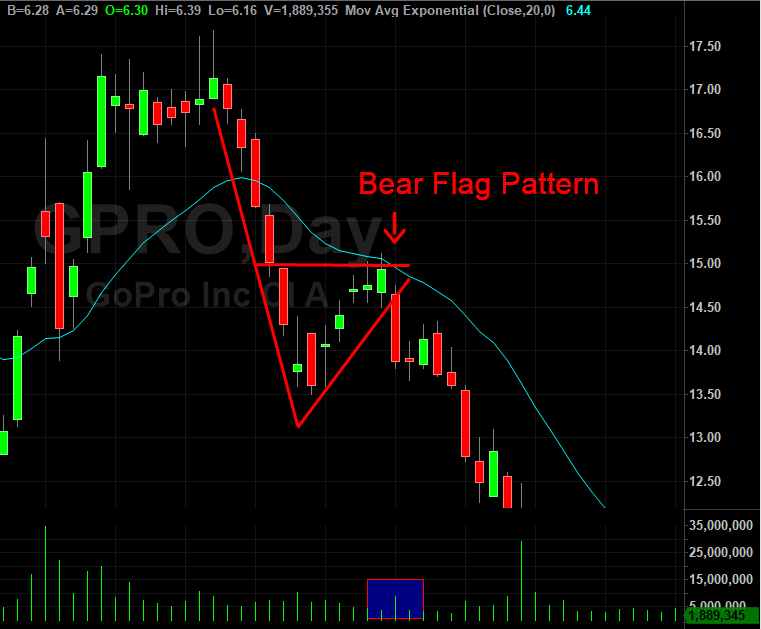

9 My Tips to Use This Strategy on Day Trades. 92 Remember That Stocks Can Offer You a Second Entry. The flag pattern can be bullish or bearish.

The Bull Flag and Volume Trading volume is an additional key element in identifying a bull flag. Ad Whether before during or after a bull market learn ways to help manage investments. Stocks On Fire.

Bull flags can be found on any time frame you use for trading. Traders may find it while trading any market including forex stocks indices cryptocurrencies etc. Volume should be stronger than what carried the price into the flag consolidation.

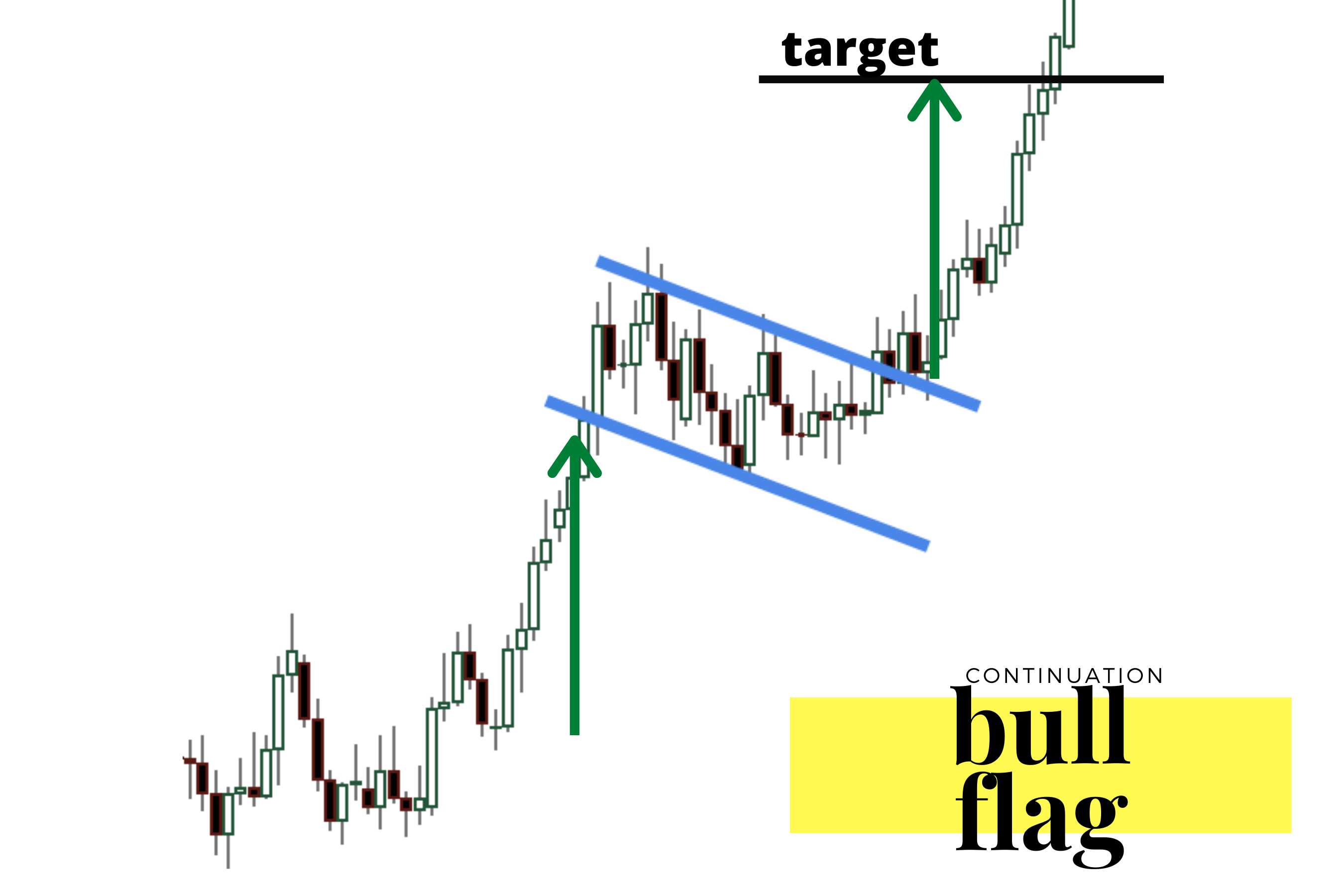

This means the range. The initial targets on all flag patterns will be the high or low of the flagpole. If Amazon trades lower than the 113 mark the bull flag will be negated due to the stock falling more than 50 of the length of the pole.

Key things to look out for when trading the bull flag pattern are. Once the pole is. Flags and pennants require evidence of a sharp advance or decline on.

Ad Generate returns with typically low correlations to traditional markets starting at 500. We can help guide you through all phases of bull markets. The first entry is on the flag break and the second potential entry is on the break of the high of the flagpole.

Preceding uptrend flag pole Identify downward sloping consolidation bull flag If the retracement becomes. Ad Whether before during or after a bull market learn ways to help manage investments. Look for a strong trending move higher.

When you couple them with moving averages like the 9 and 20 exponential moving averages you can have a. Airbnb ABNB -588 and Meta Platforms META -458 are. By connecting the peaks and lows of the candle bodies in the flag formation we form a channel.

In this video youll learn how to identify a bull flag pattern how its used to determine potential buy signals and price targets and the risks and goals. Heres a template you can use If the price breaks out of a. Amazon has resistance above at 12224.

Bull Flag Chart Pattern How To Use In Trading Libertex Com

How To Trade Bull Flag Pattern Six Simple Steps

Bull Flag Chart Pattern Trading Strategies Warrior Trading

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw

Bullish Flag Chart Patterns Education Tradingview

Bull Flag Vs Bear Flag And How To Trade Them Properly

Bullish Flag Chart Patterns Education Tradingview

Flag Patterns Bullish And Bearish Accendo Markets

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

Bull Flag Pattern New Trader U

How To Trade Bullish Flag Patterns

How To Trade Bullish Flag Patterns

Learn Forex Trading The Bull Flag Pattern

Bull Flag Trading 12 Epic Tips Trading Strategies

Bull Flag Chart Pattern How To Use In Trading Libertex Com

Flag Bullish Bearish Chart Pattern By Ktitrading Com Medium

:max_bytes(150000):strip_icc()/dotdash_Final_Flag_May_2020-01-337783b3928c40c99752093e6cb03f6d.jpg)